In Singapore’s B2B market, visibility is not enough. Your competitors are already investing in demand generation services that combine email, LinkedIn, events, and ads. What separates leaders from the rest is not how loud they are, but the numbers they track.

Demand generation is no longer about one-off campaigns. It is about measurable systems that keep your pipeline moving. Metrics like conversion rate, cost per lead, pipeline velocity, and deal size tell you if your strategy is working. Without numbers, you are guessing.

Top performers in Singapore measure and refine at every step. They use metrics to focus on high-value accounts, shorten sales cycles, and prove ROI to leadership. When done right, demand generation in Singapore creates not only awareness but also predictable revenue growth.

What Makes Singapore Different for Demand Generation

Singapore is Asia’s financial and technology hub. Many regional headquarters, venture-backed startups, and global service providers operate here. This creates a competitive environment where buyers receive multiple pitches every day.

The challenges are unique:

- Smaller buyer pools. Unlike the US or China, Singapore has fewer companies, which means fewer decision-makers. This makes precision targeting essential.

- High buyer expectations. Business leaders in Singapore expect personalized outreach and concrete value. Generic templates are ignored.

- Complex deals with longer cycles. Large B2B purchases often take six months or more. Multiple stakeholders get involved. Demand generation must nurture prospects consistently.

- Regional influence. Many Singapore-based leaders hold budget authority for Southeast Asia. Winning one account here often opens doors to multiple countries.

Because of these dynamics, companies cannot afford scattershot marketing. Demand generation in Singapore is about hitting the right accounts with the right mix of touchpoints and tracking how every action performs.

Accelerate your sales with a demand generation workflow designed for Singapore’s market.

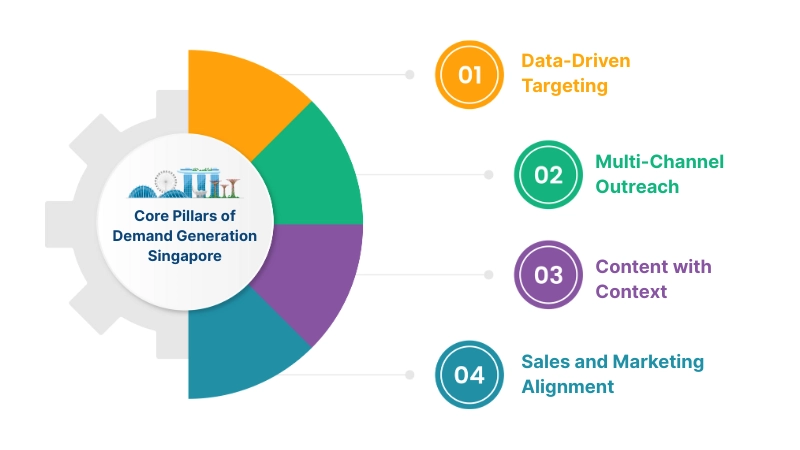

Core Pillars of Demand Generation Singapore

1. Data-Driven Targeting

Accurate data is the starting point. A wrong phone number or an outdated email wastes time and lowers trust. In a small market, that cost is multiplied.

Practical steps:

- Define your Ideal Customer Profile (ICP) down to role, region, and company size.

- Use intent data to identify accounts showing signs of active research.

- Continuously enrich and validate databases with fresh information.

Companies with clean, accurate lists see higher engagement rates and lower CPL. Without reliable data, every other demand generation effort fails.

Explore 7 considerations why you should include purchased contact lists in your marketing mix.

2. Multi-Channel Outreach

Decision-makers use different platforms during their buying journey. If you only rely on email, you miss opportunities. Singapore buyers expect to see your brand across multiple channels.

Channels to combine:

- Phone calls for direct conversations.

- Email sequences for consistent nurturing.

- LinkedIn for visibility and authority.

- Retargeting ads to reinforce awareness.

- Events and webinars for high-value connections.

Firms that combine these touchpoints often report faster response times and higher meeting acceptance rates compared to those relying on one channel.

3. Content with Context

Content must show relevance. A whitepaper written for a US audience often falls flat in Singapore. Buyers here want proof that you understand their challenges.

Effective content includes:

- Case studies with regional benchmarks.

- ROI-driven guides showing clear financial impact.

- Webinars featuring peers from the same industry.

- Articles that reference Singapore’s business culture and regulations.

Localized content not only builds trust but also supports compliance with local data and privacy laws.

4. Sales and Marketing Alignment

Sales and marketing must work as one team. Without alignment, leads get lost or mishandled. In Singapore, where deal cycles are long and touchpoints many, this alignment is even more critical.

Steps to align:

- Define clear lead qualification standards.

- Share dashboards and pipeline reports weekly.

- Use one CRM to track all interactions.

- Set joint revenue goals, not separate ones.

Companies that align sales and marketing often see higher conversion rates from MQL to SQL and smoother pipeline progression.

Is your current sales and marketing strategy not driving leads?

Best Practices for Demand Generation in Singapore

Focus on Quality Metrics, Not Volume

Singapore’s buyer base is small, which means spamming large lists rarely works. The measure of success is engagement and conversion, not how many names you collect.

A B2B firm running targeted campaigns in Singapore doubled its SQL conversion rate by filtering out non-ICP contacts and focusing only on high-value accounts. The numbers proved that smaller lists, properly refined, delivered stronger ROI than high-volume outreach.

Track Cost-Efficiency Metrics

You need to know your cost per lead (CPL) across different channels. For B2B SaaS and services, CPL ranges from USD 50 to 200, depending on targeting complexity.

One Singapore financial services provider increased lead conversion rates by 60 percent after automating qualification and cutting low-yield ad spend. Tracking CPL revealed where money was wasted and where efficiency improved.

Measure and Optimize ROI by Channel

Not all channels are equal. Benchmarks show SEO returning up to 748 percent ROI, email at 261 percent, and webinars at 213 percent.

A Singapore software company shifted spend from general ads to LinkedIn campaigns and webinars. Lead quality rose by 45 percent, proving that tracking ROI by channel makes budget decisions clearer and more effective.

See how Callbox supports an AI Platform Firm to generate Webinar Registrations.

Track Pipeline Performance

Conversion rates, velocity, and sales cycle length are vital metrics. They show where prospects drop off.

One regional B2B provider reported a 230 percent increase in marketing-sourced pipeline after monitoring pipeline velocity. They found prospects stalled after first contact, refined follow-up timing, and kept deals moving forward.

Use ABM with Clear Metrics

Account-Based Marketing (ABM) fits Singapore well because of its concentrated buyer base. ABM campaigns often deliver deal sizes 30 percent larger than traditional outreach.

Many companies strengthen ABM execution by partnering with providers of demand generation services. These services combine data enrichment, multi-channel outreach, and compliance monitoring, making it easier to track account engagement and meeting-to-deal conversion.

Ensure Compliance Metrics Are Tracked

Singapore’s PDPA enforces strict rules on data collection and usage. Fines can reach up to SGD 1 million.

Track metrics like consent rates, opt-outs, and deletion requests. Compliance is not just about legal safety, it is also a trust factor with prospects who want to know their data is handled responsibly.

Tools and Benchmarks for Demand Generation Singapore

Numbers matter only when you measure them against a standard. Many B2B leaders in Singapore ask the same question: what does good look like? Benchmarks provide a reference point. They help you see if your campaigns are underperforming, average, or ahead of the market. Tracking these metrics against benchmarks lets you decide where to double down and where to adjust.

| Metric / Tool | Benchmark / Insight | Why It Matters |

| Email Response Rate | 1–3% for targeted B2B campaigns | Measures relevance and targeting |

| Cost Per Lead (CPL) | USD 50–200 depending on targeting complexity | Enables cost-efficient budgeting |

| ROI by Channel | SEO: 748%, Email: 261%, Webinars: 213% | Identifies high-return channels |

| ABM ROI | 76% of marketers rank ABM as highest-ROI strategy | Validates ABM adoption in Singapore |

| Touches Before Meeting | 6–8 interactions needed before a first B2B meeting in Singapore | Reinforces need for multi-channel nurturing |

| Key Tools | HubSpot, LinkedIn Sales Navigator, ZoomInfo, Callbox Smart Engage | Supports data accuracy, outreach, and reporting |

These benchmarks are not static targets. They are indicators that shift as buyer behavior changes. In Singapore, where decision-makers expect multiple touchpoints and high personalization, companies that track these numbers consistently stay ahead. The most effective teams do not only collect data. They act on it, compare it with benchmarks, and refine campaigns until they outperform the standard.

Find out how the Outsourced Lead Generation program helped a Pioneering Technology Company increase its client base.

Key Takeaway: Benchmarks give you context, but the real advantage comes from acting on the numbers faster than your competitors.

How to Choose a Demand Generation Partner in Singapore

Outsourcing demand generation services helps scale outreach without building large in-house teams. In Singapore, where markets are small but high-value, a partner should deliver measurable results and regional strength.

Ask these questions:

- Do they understand Singapore and the region? Local compliance and buyer culture matter. A regional presence with APAC coverage ensures campaigns are relevant and lawful.

- Do they offer multi-channel outreach? Effective demand generation needs phone, email, LinkedIn, events, and digital.

- Do they enrich and validate data? Outdated lists reduce ROI and damage brand trust.

- Do they provide transparent reporting? Weekly numbers on leads, conversions, and pipeline progression are non-negotiable.

- Do they align with sales outcomes? The best partners track conversions and revenue impact, not just raw lead volume.

A strong regional provider helps Singapore-based companies scale into nearby markets while staying compliant and efficient.

Final Thoughts

Demand generation in Singapore is a numbers-driven process. You win when you track conversion rates, CPL, ROI, and pipeline velocity. You lose when you chase volume without measuring outcomes.

The leaders who succeed treat demand generation as a measurable system. They track every stage, align sales and marketing, and use multi-channel campaigns. Singapore’s buyers demand precision, compliance, and value. Metrics tell you if you are delivering those.

The question is not whether you are running demand generation in Singapore. The question is whether you are tracking the right numbers and adjusting fast enough to stay ahead.